Operational costs continue to rise for property managers, especially when teams still handle rent payments manually. From chasing late payers to processing checks, every step adds labor hours and increases the risk of errors. This is why autopay adoption has become one of the most effective cost-saving strategies in residential real estate.

Autopay not only ensures predictable monthly revenue but also reduces the repetitive administrative work that takes staff away from higher-value tasks. When combined with smart incentives, residents are far more likely to enroll—unlocking immediate operational savings.

In this blog, we explore how autopay incentives lower costs, improve resident satisfaction, and streamline payment operations.

Why do manual payment operations cost property managers more

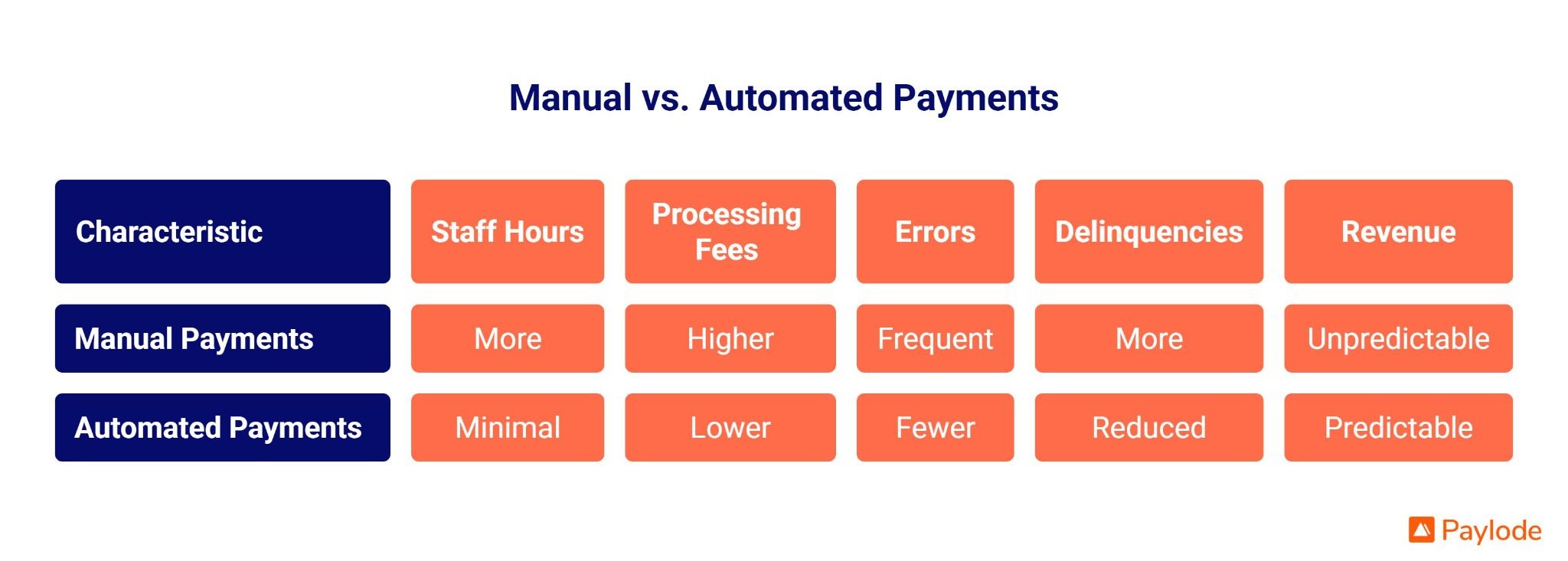

Manual rent payment processes may seem manageable at first, but they quickly become one of the most expensive operational workflows in residential real estate. When teams rely on checks, manual reminders, and inconsistent follow-ups, both time and money are lost every month.

Here’s why manual payment operations drive up costs:

- Labor hours spent chasing late rent.

Teams spend valuable time sending reminders, making calls, and managing follow-ups instead of focusing on resident experience or retention. - Higher payment processing and administrative errors.

Manual entry increases the likelihood of incorrect amounts, duplicate postings, or misplaced checks — each requiring additional staff hours to fix. - Increased delinquency risk.

When residents rely on manual payments, late or missed payments become more common, directly affecting NOI and operational stability. - Poor predictability in revenue tracking.

Without automated payments, accounting teams struggle to forecast monthly revenue accurately, making it harder to plan budgets and portfolios.

2. How autopay incentives reduce operational costs

Autopay incentives do more than encourage residents to switch payment methods—they directly reduce the operational burden on property teams. By shifting from manual processes to automated, scheduled payments, operators gain efficiency, predictability, and long-term cost savings.

2.1 Lower administrative burden

Autopay significantly reduces the hands-on work required each month.

- Fewer staff hours are spent contacting residents.

- Less manual data entry and fewer repetitive tasks.

- Reduced error corrections and back-and-forth communication.

2.2 Fewer late payments and delinquencies

When payments run automatically, compliance improves across the board.

- Autopay ensures consistent, on-time payments.

- Leads to predictable revenue forecasting and financial stability.

2.3 Reduced payment processing costs

Digital adoption directly cuts transaction and manual handling expenses.

- Digital payments cost less than manual check processing.

- Operators can negotiate better rates as digital adoption increases.

2.4 Increased resident satisfaction & retention

Autopay makes the payment journey smoother for residents.

- Payments become frictionless and effortless.

- Lower frustration around due dates and reminders.

- Happier residents tend to stay longer, thereby improving portfolio performance.

Discover how incentives promote increased resident retention.

Why incentives work: Behavioral triggers that drive autopay adoption

Getting residents to switch payment habits can be challenging, but incentives make the transition easier and more motivating. The right reward at the right moment removes friction and encourages residents to take action quickly.

Residents naturally respond better to instant rewards than to complicated, points-based systems. When they see a perk immediately, the value feels real, tangible, and worth the effort of enrolling in autopay.

Even small perks—like merchant-funded offers, gift cards, or exclusive discounts—lower resistance to change. These rewards remove the mental barrier of “I’ll do it later” and help residents complete the switch on the spot.

Most importantly, autopay incentives align perfectly with residents’ expectations of convenience. Today’s renters expect fast, digital, and effortless experiences, especially in residential real estate. Autopay paired with incentives delivers exactly that.

Examples of high-performing autopay incentives

The Paylode advantage: Automated, merchant-funded autopay incentives

What makes Paylode different is its ability to automate the entire incentive process from end to end. Instead of manually managing rewards, chasing residents, or coordinating vendors, Paylode handles the full workflow automatically—saving property teams hours each month.

Paylode’s platform uses merchant-funded perks, which means operators don’t have to spend budget on incentives. Residents receive high-value offers at no cost to the property management team, making it one of the most cost-effective ways to boost autopay adoption.

This automation directly contributes to reduced OPEX. With fewer manual tasks, fewer payment issues, and fewer resident follow-ups, property teams can redirect their time toward higher-impact activities. The streamlined setup available through Paylode Boost ensures incentives reach residents instantly and consistently.

Step-by-step process to launch autopay incentives

Launching autopay incentives is simple when the workflow is structured and automated. Here’s a clear, repeatable process operators can use to drive fast adoption across their portfolio:

- Identify residents not enrolled in autopay.

Pull a list of renters still paying manually through checks or one-time online payments. - Set up merchant-funded incentives via Paylode.

Choose high-value perks that motivate residents without increasing operator costs. - Add messaging inside the resident portal.

Highlight the benefits of autopay and the reward residents will receive for enrolling. - Trigger automated email and SMS nudges.

Automated reminders encourage residents to complete enrollment with minimal staff effort. - Track autopay enrollments and cost savings.

Monitor adoption rates and compare operational workload before and after incentives.

To simplify setup and automation, learn more about the Paylode Platform.

Real-world operational impact for property managers

When property managers implement autopay incentives, the operational benefits show up quickly. By shifting residents toward automated payments, teams experience immediate time savings, lower expenses, and stronger financial performance across their portfolio.

- 20–40% reduction in staff time spent on rent collection.

- Lower lockbox, check, and manual processing costs.

- Higher on-time payments leading to improved NOI.

- Stronger resident retention thanks to smoother, more convenient payments.

Conclusion

Autopay incentives are one of the most effective ways for property managers to reduce operational costs, increase on-time payments, and deliver a smoother resident experience. By shifting away from manual payment processes, operators save time, minimize errors, and boost overall NOI. And with merchant-funded perks, the entire strategy becomes cost-neutral — delivering value to residents without adding strain to operating budgets.

Platforms like Paylode make this transition simple by automating the incentive workflow, delivering rewards instantly, and removing administrative overhead. The result is a scalable, low-effort solution that improves both operational efficiency and resident satisfaction.

FAQs

1. How do autopay incentives reduce operational costs for property managers?

Autopay incentives encourage residents to shift from manual payments to automated billing, which reduces staff time spent on follow-ups, lowers administrative errors, decreases delinquencies, and improves revenue predictability. All of this contributes to meaningful operational cost savings.

2. What types of incentives work best for autopay adoption?

Instant, merchant-funded perks such as gift cards, discounts, and local offers work best. They deliver immediate value, require no points or tracking, and motivate residents to enroll in autopay quickly.

3. Are merchant-funded perks really free for operators?

Yes. Merchant-funded perks come at no cost to the operator because the value is subsidized by participating retailers. This allows property managers to offer compelling rewards without increasing their budget.

4. Can autopay incentives improve resident satisfaction?

Absolutely. Autopay reduces stress around due dates and minimizes the risk of late fees. When paired with meaningful perks, it creates a smoother, more rewarding payment experience—ultimately increasing resident satisfaction.

5. How does Paylode automate the incentive workflow?

Paylode automates the full process—from enrolling residents into autopay campaigns to delivering rewards instantly. This removes manual effort for onsite teams and ensures consistent, high-quality resident engagement.