Tremendous has become a well-known platform for distributing digital gift cards and incentives. It allows businesses to send rewards quickly, making it a convenient choice for one-off recognition or customer thank-yous. But in 2025, many companies are realizing that gift cards alone don’t build lasting loyalty. They deliver value once but fail to create deeper, ongoing engagement with customers.

That’s why more businesses are looking for a Tremendous alternative—a loyalty solution that goes beyond transactional rewards and focuses on retention, customer lifetime value, and measurable ROI.

Enter Paylode, the best Tremendous alternative in 2025. Instead of relying on gift cards, Paylode is built on pointless rewards—instant, merchant-funded perks that customers can redeem immediately. This approach eliminates the waiting, tracking, and high costs of traditional incentive models while creating meaningful touchpoints that drive long-term loyalty.

With Paylode, businesses can integrate perks directly into customer journeys, automate delivery with behavior triggers, and personalize rewards based on customer data. Industries with recurring relationships—like telecom, ISPs, real estate, and banking—use Paylode to reduce churn, boost satisfaction, and raise customer lifetime value. For example, financial services loyalty software helps banks turn routine transactions into engagement opportunities with perks that customers actually value.

In this blog, we’ll explore why companies are seeking alternatives to Tremendous, and why Paylode is the smarter, more scalable solution for loyalty in 2025.

Why businesses seek a Tremendous alternative

Tremendous has carved out a niche as a reliable gift card distribution platform. It’s simple, fast, and convenient for organizations that want to send digital rewards with minimal setup. But as customer expectations evolve in 2025, businesses are starting to see the cracks in a gift-card-only approach.

Here are the most common challenges companies face with Tremendous:

- One-off incentives, not loyalty

Tremendous rewards are transactional. Customers redeem a gift card and the interaction ends. There’s no built-in mechanism for ongoing engagement or long-term loyalty. - Business-funded model

Every gift card comes directly out of the company’s budget. There’s no option for merchant-funded rewards, which makes it expensive to scale. - Generic experience

Customers don’t associate Tremendous gift cards with your brand. They see it as a pass-through incentive, not a meaningful extension of your relationship. - No behavioral reinforcement

Gift cards may encourage a single action (e.g., completing a survey), but they don’t reinforce repeat behaviors like renewals, upgrades, or ongoing usage. - Limited analytics

Businesses get redemption data, but not deeper insights into loyalty metrics such as churn reduction, activation rates, or customer lifetime value.

In today’s competitive environment, companies need more than one-off incentives. They need loyalty solutions that are integrated, automated, and tied to real business outcomes. Industries like telecom, ISPs, banking, and healthcare require tools that can drive retention, not just recognition.

That’s why many businesses are now searching for a Tremendous alternative—a platform that delivers instant, ongoing value while proving ROI. This is where Paylode shines.

Why Paylode is the best Tremendous alternative

Tremendous is great for distributing digital gift cards, but when it comes to building lasting loyalty, it falls short. Businesses today need solutions that create ongoing engagement, measurable retention, and higher customer lifetime value (CLV). That’s exactly what Paylode delivers.

Here are 10 reasons why Paylode is the best Tremendous alternative in 2025.

1. Pointless rewards, not gift cards

Tremendous revolves around gift cards—useful, but transactional. Customers redeem once and forget about it. Paylode introduces pointless loyalty: instant perks delivered at the right moment. Whether it’s a streaming subscription for a telecom renewal or a grocery discount for a tenant’s on-time payment, customers get value instantly. This approach fosters repeated engagement rather than one-and-done transactions, making Paylode far more effective for retention-driven industries.

2. Digital-first experience

While Tremendous delivers codes via email, Paylode goes fully digital with wallet passes, QR codes, and app-based delivery. Customers can access perks instantly from their phones—no lost emails, no forgotten codes. This mobile-first experience ensures higher adoption rates and keeps perks top-of-mind. For businesses, it reduces delivery costs and makes loyalty effortless.

3. Merchant-funded perks marketplace

Tremendous requires businesses to fund every gift card, driving up costs. Paylode flips the model with a Perks marketplace where rewards are merchant-funded. Customers gain access to valuable lifestyle perks—food delivery, fitness memberships, entertainment, and more—without straining company budgets. Merchants win exposure, customers win perks, and businesses win loyalty. This cost-efficient ecosystem is a major advantage over Tremendous.

4. Automated engagement with Boost

Gift cards from Tremendous are typically manual or campaign-based. Paylode’s Boost automates rewards based on behavior triggers:

- A customer renews their subscription → unlock a free streaming trial.

- A patient attends a checkup → earn a wellness perk.

- A resident renews a lease → receive a dining discount.

Automation ensures perks are always timely, relevant, and scalable. It saves teams time and guarantees that engagement never goes stale.

5. Seamless integrations

Paylode integrates with CRM systems, billing platforms, POS systems, and mobile apps. This allows rewards to be tied directly to real customer actions. For example, a bank can integrate Paylode with transaction data to deliver perks for spending milestones. A telecom provider can connect it to billing systems to reward timely payments automatically. Unlike Tremendous, Paylode makes loyalty an integrated part of the customer journey, not a disconnected afterthought.

6. Industry scalability

Tremendous provides generic incentives, but Paylode adapts to industries where retention matters most:

- Telecom & ISPs: Fight churn with lifestyle perks for renewals → see ISP loyalty solutions

- Real estate: Enhance resident satisfaction with perks like grocery or fitness offers

- Financial services: Deepen engagement through lifestyle perks tied to everyday transactions

- Digital health: Encourage healthy behaviors like checkups and medication adherence

Paylode’s industry-specific flexibility makes it far more strategic than Tremendous for long-term loyalty.

7. Raise customer lifetime value

Gift cards may create a single action, but they don’t move the needle on CLV. Paylode ties perks directly to measurable outcomes—renewals, upsells, increased frequency, and reduced churn. By aligning perks with key behaviors, Paylode helps businesses raise customer LTV sustainably. Every reward becomes an investment in growth, not just an expense.

8. Data-driven personalization

Tremendous rewards are the same for everyone. Paylode uses customer data to segment audiences and deliver perks that feel personal. Frequent travelers might get ride-share credits, families may get grocery perks, and wellness-focused customers can unlock fitness offers. Personalization not only increases redemption but also creates emotional loyalty—customers feel seen and valued.

9. Sustainability & cost efficiency

Gift cards are digital, but they’re costly for businesses to fund. Paylode’s merchant-funded perks are eco-friendly and budget-friendly. No plastic, no liability-heavy points, and no overspending. This makes Paylode a sustainable loyalty solution for companies aiming to meet both financial and ESG goals.

10. All-in-one loyalty platform

Instead of piecing together separate systems for rewards, automation, and analytics, Paylode offers a complete loyalty platform. Businesses can:

- Access the Perks marketplace

- Automate campaigns with Boost

- Integrate with CRM and billing

- Measure KPIs like activation, redemption, CLV, and churn

Tremendous distributes rewards; Paylode builds loyalty. That’s why it’s the best Tremendous alternative for 2025.

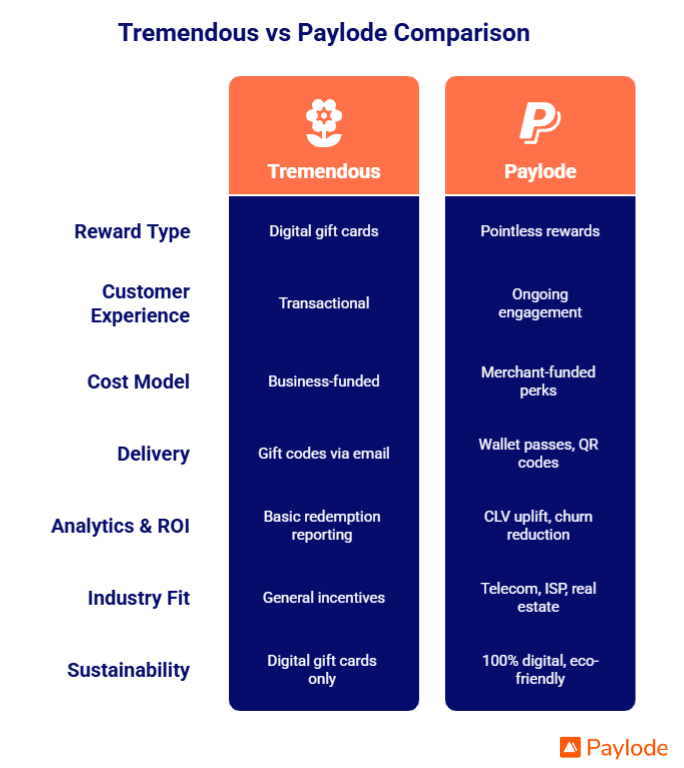

Tremendous vs Paylode: A clear comparison

At first glance, Tremendous and Paylode both help businesses distribute rewards digitally. But when you look closer, the difference is clear: Tremendous is a gift card distribution tool, while Paylode is a full loyalty platform designed to build ongoing engagement.

Here’s how they compare side by side:

The takeaway is simple: Tremendous is built for single-use incentives, while Paylode is built for long-term loyalty and measurable ROI. Businesses that need more than transactional rewards choose Paylode.

How Paylode drives loyalty across industries

While Tremendous is limited to distributing gift cards, Paylode is built to scale across industries where retention, satisfaction, and recurring engagement directly impact revenue. Its pointless rewards model delivers instant perks that feel relevant to customers while driving measurable business outcomes.

Here’s how Paylode creates impact in key sectors:

- Telecom providers

In a competitive industry with high churn, telecoms can use Paylode to deliver perks like bonus data or streaming subscriptions for renewals and upgrades. These perks create stickiness and reduce switching. - ISPs (Internet Service Providers)

With ISP loyalty solutions, providers can add lifestyle perks to subscriptions, making internet service feel more valuable. Perks like food delivery credits or entertainment bundles improve satisfaction without cutting into margins. - Residential real estate

Property managers can enhance resident experiences with perks tied to lease renewals, referrals, or on-time payments. Something as simple as a grocery discount or fitness membership can turn tenants into long-term residents. - Financial services

Banks and fintechs can pair Paylode with financial services loyalty software to deepen relationships. Everyday transactions like debit card swipes or account milestones become opportunities for instant perks, building trust and engagement. - Digital health

With digital health loyalty software, providers can encourage preventive care and healthier behaviors. Patients might unlock wellness perks for attending checkups or adhering to treatment plans, improving both outcomes and loyalty.

Across all these industries, Paylode transforms loyalty into a continuous journey instead of a single redemption moment. It makes rewards feel personal, contextual, and sustainable—everything Tremendous cannot offer.

Conclusion

Tremendous has earned its place as a simple digital gift card distribution tool. But in 2025, businesses need more than one-off incentives to keep customers engaged. Loyalty today requires instant, personalized, and ongoing value—something Tremendous can’t deliver on its own.

That’s where Paylode comes in. As the best Tremendous alternative, Paylode replaces gift cards with pointless rewards—merchant-funded perks that customers can use instantly. Instead of spending heavily on gift cards, businesses can deliver meaningful lifestyle benefits while lowering costs. More importantly, these perks are tied directly to customer behaviors that reduce churn, improve satisfaction, and raise customer lifetime value.

Paylode is more than rewards software—it’s an all-in-one loyalty platform. From its perks marketplace to Boost automation, seamless integrations, and advanced analytics, Paylode makes it easy to launch, scale, and prove ROI on your loyalty initiatives. Whether you’re in telecom, ISPs, banking, real estate, or healthcare, Paylode helps transform everyday transactions into lasting engagement.

FAQs

1. What is the best Tremendous alternative in 2025?

The best Tremendous alternative is Paylode, a loyalty platform that delivers pointless rewards—instant, merchant-funded perks instead of digital gift cards. Paylode creates ongoing engagement, reduces churn, and raises customer lifetime value.

2. How is Paylode different from Tremendous?

Unlike Tremendous, which focuses on one-off gift cards, Paylode integrates perks directly into customer journeys. It automates delivery, personalizes rewards, and measures ROI through CLV uplift and churn reduction.

3. Why are instant perks better than gift cards?

Instant perks are simple, personalized, and tied to customer behaviors like renewals or referrals. Gift cards, by contrast, feel transactional and often don’t foster repeat engagement.

4. Which industries benefit most from Paylode?

Paylode is especially powerful for recurring-revenue industries such as telecom, ISPs, residential real estate, financial services, and digital health.

5. Does Paylode reduce costs compared to Tremendous?

Yes. Paylode leverages merchant-funded perks, lowering operational expenses. This makes it more cost-efficient than business-funded gift card models.

6. Is Paylode eco-friendly compared to Tremendous?

Yes. Paylode eliminates plastic cards and liability-heavy points, offering 100% digital, eco-friendly perks that align with sustainability and ESG goals.